Corporate Governance

Basic Policy on Corporate Governance

Kureha is committed to strengthening its internal control functions including practicing compliance, enhancing risk management and ensuring fair and highly transparent management. In addition, Kureha has adapted Corporate Governance Guidelines, which are separately established to further enhance the effectiveness of its corporate governance, through which Kureha pursues sustainable growth and improving the medium- and long-term growth of corporate value for the Kureha Group (Kureha and Group companies).

Corporate Governance Structure

In order to strengthen corporate governance and speed up decision-making and business execution in the Group management, Kureha has clarified its supervisory and executive responsibilities in management.

Board of Directors

The Board of Directors, which consists of a total of up to ten Directors, at least one-third of whom are Independent Outside Directors, and chaired by the Chairman of the Board of Directors (if the position is vacant, the President & Chief Executive Officer), meets once a month, in principle, to make decisions on important management matters and supervise business execution.

In appointing Directors, the Company places the highest priority on their experience in corporate management. And by creating a skills matrix that lists candidates’ areas of expertise and experience, and combining different specialist areas and backgrounds, the Company comprehensively takes into account factors such as the balance of knowledge, skills and experience within the Board of Directors as a whole; its diversity including gender, international character, career background, and age aspects; and the appropriate size of the Board to make the final decision.

Executive Committee

The Executive Committee, chaired by the President & Chief Executive Officer and comprised of the President & Chief Executive Officer and other Vice Presidents, meets twice a month, in principle, to deliberate on important matters and other issues related to the management of Kureha, ensuring that management decisions are efficiently made.

Audit & Supervisory Board

The Audit & Supervisory Board, comprised of up to four members including two or more Independent Outside Auditors and chaired by a full-time Audit & Supervisory Board Member, meets once a month, in principle, to discuss matters of authority granted to the Audit & Supervisory Board, etc. and share audit information in order for Audit & Supervisory Board Members to effectively and efficiently audit the execution of duties by Directors.

Independent Auditor

Kureha has appointed Ernst & Young ShinNihon LLC as its Independent Auditor and received fair and unbiased accounting audit, including appropriate provision of management information.

Internal Control and Auditing Department

The Internal Control and Auditing Department assesses and verifies, independently of other departments, the suitability and effectiveness of internal management systems including compliance and risk management systems, and makes suggestions and recommendations for improvement and reports the results of internal audit to the Executive Committee, the Board of Directors, and the Audit & Supervisory Board. In this way, Kureha ensures a system that contributes to the enhancement of management efficiency and public trust in Kureha.

Nomination Advisory Committee and Remuneration Advisory Committee

With regard to matters concerning the appointment and remuneration of the Chairman of the Board of Directors, President & Chief Executive Officer, Representative Director, Directors, Vice Presidents with Title, and Vice Presidents in order to ensure transparency in the decision-making process of the Board of Directors and strengthen accountability to stakeholders, Kureha established the Nomination Advisory Committee and the Remuneration Advisory Committee on June 26, 2018 as a non-mandatory advisory board to the Board of Directors. Each of the Committees consists of three or more Directors, the majority of whom are Outside Directors, and is chaired by an Outside Director.

Assessment of the Effectiveness of the Board of Directors

To improve the functions of the Board of Directors, Kureha shall conduct an annual analysis and evaluation of the effectiveness of the Board of Directors and disclose an overview of the results.

The evaluation of the effectiveness of the Board of Directors in FY2024 confirmed that the effectiveness of the Board of Directors as a whole was adequately maintained. Regarding the need to improve how the Board of Directors meetings are run, which was recognized as an issue as a result of the evaluation of the effectiveness in FY2023, more time was allocated to discussion rather than reporting. As a result, improvement was recognized. On the other hand, there was an opinion that more in-depth discussions are needed on the status of major businesses and future initiatives, sustainability issues, and the business portfolio.

In FY2025, the status of major businesses and future initiatives will be discussed as themes continued from FY2024, while sustainability issues and the business portfolio will be discussed as themes for FY2025. In addition to these themes, deliberations will be deepened with a focus on the themes that were specified in open-ended comments as themes to be discussed at Board of Directors meetings in FY2025, such as management that is conscious of cost of capital and stock price, the revival as a technology-driven company, and formulation of the next med-term management plan.

Corporate Governance Structure

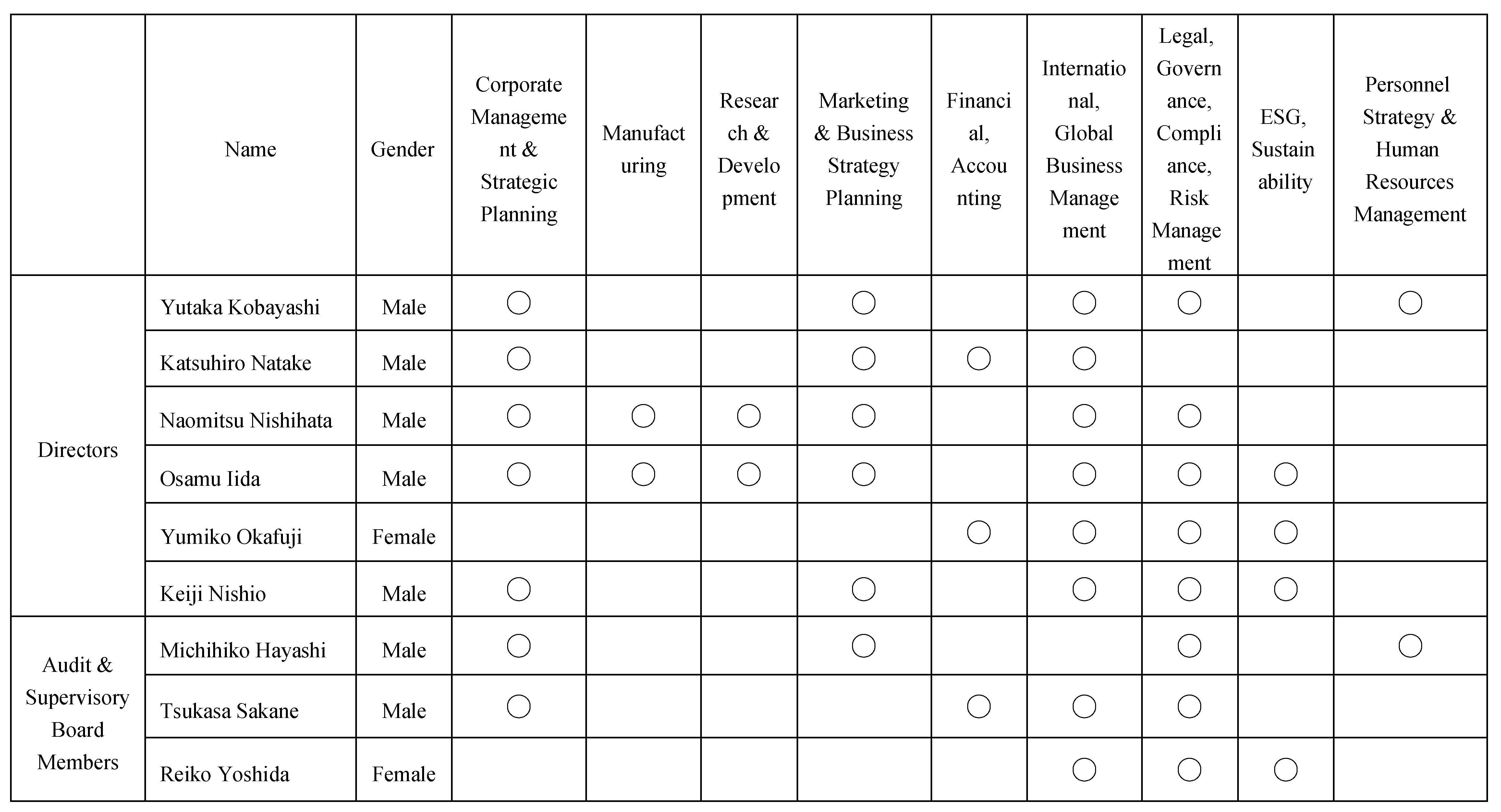

Skills and Experiences of Board Directors

(As of June 26, 2025)

Corporate Governance Report

Corporate Governance Guidelines

Internal Control System

Kureha aims to further improve internal control with the corporate philosophy system as the basic concept for internal control. In accordance with the Kureha Group Charter of Corporate Behavior, each Group company establishes its own Compliance Rules and strives to comply with domestic and international laws, as well as social norms and their underlying principles. Kureha establishes a Sustainability Coordination Committee, chaired by the President & Chief Executive Officer or a Director or Vice President appointed by the President & Chief Executive Officer. Under this committee, the Compliance Subcommittee is established as a subordinate body responsible for developing, maintaining, and operating a cross-departmental compliance system. Kureha ensures thorough compliance within the company through measures such as the Kureha Compliance Code of Conduct, which is based on the Kureha Group Charter of Corporate Behavior. Additionally, Kureha provides support to the Group companies in ensuring their own thorough compliance.

Kureha's annual internal audit plan is resolved by the Board of Directors. The Internal Auditing Department, operating independently of other departments, assesses and verifies the appropriateness and effectiveness of the internal control systems of Kureha and its Group companies, including compliance and risk management systems. It provides recommendations for improvement and reports audit results to the Executive Committee, the Board of Directors, and the Audit & Supervisory Board. This system contributes to enhancing management efficiency and strengthening public trust in Kureha.

Kureha has established Basic Rules for Internal Control over Financial Reporting and conducts Management’s Assessment and Certified Public Accountant’s Audit on the Effectiveness of Internal Control over Financial Reporting in accordance with the Financial Instruments and Exchange Act to ensure the reliability of its financial reporting. Under the responsibility of the Representative Director, Internal Control Reports are prepared and submitted.

Executive Remuneration

- When determining remuneration, etc. for Directors and Vice Presidents, the Board of Directors reflects corporate performance and medium- and long-term growth of corporate value, and also considers securing

and retaining appropriate human resources, and sets the remuneration structure and level that are appropriate to the required roles and responsibilities.

- Remuneration for Directors consists of 1) basic remuneration and 2) bonuses as performance-linked remuneration, etc. as monetary remuneration, as well as 3) pre-delivery type restricted stock remuneration and 4) performance-linked restricted stock remuneration as performance-linked remuneration, etc. as non-monetary remuneration; provided, however, remuneration for Outside Directors is limited to basic remuneration, considering their roles.

- Remuneration for Vice Presidents consists of 1) basic remuneration and 2) bonuses as performance-linked remuneration, etc. as monetary remuneration, as well as 3) pre-delivery type restricted stock remuneration as non-monetary remuneration.

- Changes to the remuneration system for Directors and Vice Presidents shall be decided by the Board of Directors based on comprehensive consideration of trends at other companies, and after deliberation by the Remuneration Advisory Committee, a non-mandatory advisory board to the Board of Directors.

Shareholding Status

Criteria and Approach for Classification of Investment Shares

Kureha holds shares either for the purpose of pure investment or for purposes other than pure investment and classifies them according to this difference. The shares classified as shares for pure investment are held for the purpose of receiving profits from fluctuations in the value of shares or dividends from the shares. The shares classified as shares for purposes other than pure investment are held based on the assumption that they will contribute to current business as well as the sustainable and medium to long-term enhancement of corporate value. Kureha does not hold shares for the purpose of pure investment.

Investment Shares held for Purposes other than Pure Investment

Policy on shareholdings, method for verifying the reasonableness of shareholdings, and details of verification of appropriateness of shareholdings for each stock conducted by the Board of Directors

Kureha holds the shares of its business partners if it is judged that doing so will contribute to current business as well as the sustainable and medium and long-term enhancement of corporate value. The Board of Directors verifies the significance of holding shares for purposes other than pure investment by examining whether the purpose of shareholdings is appropriate and whether the benefits and risks of holding the stock are commensurate with the cost of capital.

At the Board of Directors meeting held on May 17, 2024, keeping to the standard that the amount held (in total) should be less than 10% of consolidated net assets, Kureha will gradually reduce the number of shares that are no longer significant for Kureha to hold or whose holdings are excessive based on a comprehensive consideration of factors such as dialogue with companies in business relationships, the impact on the market, and availability of effective use of funds.